Committee membership

During 2014 the Committee was chaired by E. Lindqvist. The Committee also comprised J.A. Biles, A.M. Thomson, R. Rajagopal and I.B. Duncan (appointed 17 November 2014).

The Committee's full terms of reference are available on the Group's website. No Committee members have any personal financial interest (other than as a shareholder), conflict of interest, cross-directorships or day-to-day involvement in the running of the business.

Committee activities

During 2014 the Committee met five times and once in February 2015 to consider, amongst other matters:

| Theme | Agenda items |

|---|

| Best practice | - The Group's Remuneration Policy, discussions and feedback from the Group's AGM in 2014 and the revised Corporate Governance Code and Investment Management Association (IMA) guidelines on executive remuneration

- Review of the current UK corporate governance environment and the implications for the Group

|

| Remuneration Policy | - Consideration and approval of the Remuneration Policy to be put to shareholders, as summarised in Section A of the Board report on remuneration

|

| Implementation Report | - Consideration and approval of the Implementation Report to be put to shareholders and as summarised in Section B of the Board report on remuneration

|

Executive Directors'

and senior executives'

remuneration | - Basic salaries payable to each of the Executive Directors

- The annual bonus and payments for the year ended 31 December 2014

- The annual bonus structure and performance targets for the year ended 31 December 2015

- The conditional awards and vestings made under the Bodycote Incentive Plan (BIP) and Co-investment Plan (CIP) during the year

- Pension arrangements for senior executives

|

| Reporting | - Consideration and approval of the Board report on remuneration

|

Advisers to the Committee

The Committee is advised by Towers Watson on remuneration matters including providing advice on matters under consideration by the Committee, updates on good practice, legislative requirements and market practice. Towers Watson's fees for this work amounted to £17,875. Legal advice was provided by Eversheds and fees amounted to £9,545. The Remuneration Committee is satisfied that the advice provided on executive remuneration is objective and independent, and that no conflict of interest arises as a result of these services.

The Committee also received assistance from the Group Chief Executive and Group Company Secretary, although they do not participate in discussions relating to the setting of their own remuneration. The Committee in particular consulted with the Group Chief Executive and received recommendations from him in respect of his direct reports.

Statement of shareholder voting

The table below displays the voting results on the remuneration resolutions at the 2014 AGM:

| 2013 Board report on

remuneration

(% votes) | 2013 Directors'

Remuneration Policy

(% votes) |

|---|

| Votes cast | 79% | 79% |

| For | 99% | 96% |

| Against | 1% | 4% |

| Number of abstentions | 37,018 | 40,318 |

Remuneration for 2014

This section of the report explains how Bodycote's Remuneration Policy has been implemented during the financial year.

Base salary

The base salaries of the Executive Directors are reviewed on an annual basis. As described in Section A: Directors' Remuneration Policy, a number of factors are taken into account when salaries are reviewed, principally market level salaries payable in FTSE 250 companies and other companies of similar size and complexity, and the individual's role, experience and performance. The 2014 base salary increases and comparative figures can be found in the Remuneration Committee Chairman's letter.

Base salaries are reviewed in January every year.

| Name | Position | Salary from 1 January 2014 | Salary from 1 January 2015 |

|---|

| S.C. Harris | Group Chief Executive | £484,306 | £498,838 |

| D.F. Landless | Group Finance Director | £309,312 | £318,591 |

Pension

Following a contractual review of pension provision during 2013, it was decided that the salary supplement in lieu of pension rate should be increased for both Executive Directors. This was implemented on 1 April 2014.

S.C. Harris is entitled to a salary supplement in lieu of pension at a rate of 25% of basic salary. In addition, a death in service benefit of eight times basic salary is payable.

D.F. Landless no longer participates in the Group's UK contributory defined benefit and defined contribution pension schemes due to him prospectively reaching the lifetime limit. Instead Mr Landless receives a salary supplement of 25% of basic salary up to the defined benefit scheme cap and 16% of basic salary above the cap, of which £63,287 was waived during the year. In addition, a death in service benefit of eight times basic salary is payable.

Taxable benefits

The Group provides other cash benefits and benefits in kind to directors as well as sick pay and life insurance. These include the provision of company car (or allowance) and family level private medical insurance.

| Name | Car/car allowance | Fuel | Healthcare | Salary supplement |

|---|

| S.C. Harris | £13,600 | £2,400 | £1,214 | £117,444 |

| D.F. Landless | £18,830 | £1,200 | £1,518 | £63,287 |

Long-term savings vehicle

During the financial year the Group made discretionary contributions into the Bodycote Investment Incentive Plan. The plan is entirely cash-based to provide an alternative long-term savings vehicle for senior executives. The Committee considers the plan an essential tool to aid retention while recognising the need for executives to have flexibility in long-term financial planning. Group contributions are discretionary, vary year-on-year and are made in lieu of other elements of pay and therefore are cost neutral to the Group. Any risk in relation to the value of investments made in the plan is borne entirely by participants.

Annual performance-related bonus

Retrospective disclosure of 2013 annual bonus targets

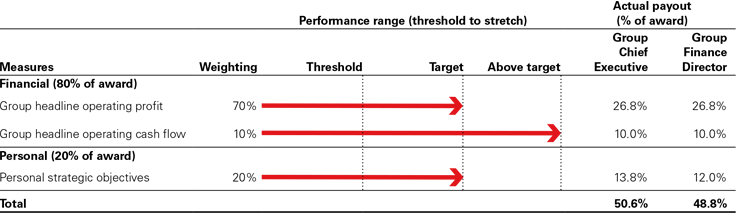

In last year's Annual report on remuneration, the Committee communicated its intention to retrospectively disclose information in respect of the 2013 annual bonus targets. The table below provides details of the annual bonus awards received in respect of the Group and individual performances in the 2013 financial year.

The financial performance of the Group was strong in 2013. Our reported revenues increased by 5.4% (3.0% at constant exchange rates) and headline operating profit grew by 10.2%. The actual payout, as a percentage of the total award, in respect of Group headline operating profit and Group headline operating cash flow, was 26.8% and 10.0% respectively. The targets for Group headline operating profit and Group headline operating cash flow were £107.8m and £93.8m respectively. The Committee also assessed the Group Chief Executive and Group Finance Director's performance against their personal objectives, which included targets relating to safety, customer service and implementation of major projects. The Committee concluded that personal strategic objectives were achieved on target at a level of 13.8% and 12.0% for the Group Chief Executive and Group Finance Director respectively.

2014 Annual bonus

The annual bonus potential for the period to 31 December 2014 for Executive Directors was split 70% in respect of Group headline operating profit, 10% Group headline operating cash flow and 20% on personal strategic objectives. These performance conditions and their respective weightings reflected the Committee's belief that any incentive compensation should be linked both to the overall performance of the Group and to those areas of the business that the relevant individual can directly influence.

The performance of the Group during the year included headline operating profit of £111.1m (a 3.4% increase on the previous year, 9.2% at constant exchange rates) and headline operating cash flow of £100.0m (an 8.2% decrease on last year).

In light of the above performance, the Committee concluded that 72.5% of maximum bonus is payable to the Group Chief Executive and 71.1% of maximum bonus is payable to the Group Finance Director. As described in Section A: Directors' Remuneration Policy, 100% of annual bonus is payable in cash.

Similar to the approach taken last year, it is the Committee's intention to disclose information relating to the performance targets for 2014 annual bonus awards in next year's Annual report on remuneration, unless disclosure of the targets would provide competitors with commercially sensitive information.

Bodycote Incentive Plan (BIP)

Awards with performance periods ending in the year

BIP awards made in 2012 had a three-year performance period ending on 31 December 2014, with 50% of the award subject to satisfaction of a ROCE target and 50% subject to a headline EPS target. The threshold and maximum targets along with the vesting schedule are set out in the tables below.

| ROCE | | Headline EPS |

|---|

| Performance target | Vesting of element

(% of maximum) | | Performance target | Vesting of element

(% of maximum) |

|---|

| Threshold performance | 18.7% | 0% | | 32.6p | 0% |

| Maximum performance | 23.0% | 100% | | 62.2p | 100% |

| Performance achieved | 20.7% | 67.2% | | 43.8p | 21.4% |

If headline EPS at the end of the performance period was below 31.1p, then no awards would vest. Over the period, ROCE was 20.7% and the headline EPS figure for the year of 43.8p represented growth of 6.3%. This performance resulted in the ROCE and headline EPS targets being achieved at a level of 67.2% and 21.4% respectively. This resulted in an overall vesting level of 44.3%. The number and value of shares which vested to each of the Executive Directors is set out in the Auditable section of this report.

Awards made in the year

BIP awards with a face value of 175% of salary were granted to both Executive Directors in April 2014 and will vest in March 2017, subject to the achievement of ROCE and headline EPS growth performance targets. The performance period will end on 31 December 2016. The vesting of these awards will be based on ROCE and headline EPS targets summarised in the table below. The Committee has reviewed the performance targets and these have been altered accordingly to ensure that they remain stretching targets which underpin the Group's objectives.

| ROCE | | Headline EPS |

|---|

| Performance target | Vesting of element

(% of maximum) | | Performance target | Vesting of element

(% of maximum) |

|---|

| Threshold performance | 18.7% | 0% | | 45.0p | 0% |

| Maximum performance | 23.0% | 100% | | 61.3p | 100% |

If headline EPS at the end of the performance period is below 41.8p, then no awards would vest. The Committee has decided that the ROCE figure of 23% is a good aspiration for the Group and is cognisant of the fact that overdriving incentives on capital employed can lead to unintended consequences in terms of short-term capital under investment for the business. Dividend equivalents are payable in respect of those shares that vest.

The number and value of shares that were awarded to the Executive Directors during the year is set out in the Auditable section.

Co-investment Plan (CIP)

Awards with performance periods ending in the year

As described in Section A: Directors' Remuneration Policy, CIP awards are subject to an absolute TSR target. The CIP awards made in 2011 had a three-year performance period ending on 30 April 2014. The absolute TSR performance targets applicable to this award are set out below.

| Absolute TSR performance target | Vesting level |

|---|

| 4% CAGR + CPI | 50% (0.5:1 match) |

| 10% CAGR + CPI | 100% (1:1 match) |

Over the three-year period, the Group achieved absolute TSR growth of 36.3%. This performance resulted in the TSR targets being achieved at a level of 100%. The number and value of shares which vested to each of the Executive Directors is set out in the Auditable section.

Awards made in the year

CIP awards were made to both Executive Directors in May 2014 and will vest in May 2017, subject to the achievement of absolute TSR targets summarised in the table below. The Committee reviewed the performance targets and felt that they remain appropriately stretching. Therefore, no change has been made to the absolute TSR performance targets used in the previous year. Dividend equivalents will be payable in respect of the shares which vest.

| Performance target | Threshold | | Maximum |

|---|

| Target | Vest | | Target | Vest |

|---|

| Absolute TSR | 4% CAGR + CPI | 50% (0.5:1 match) | | 10% CAGR + CPI | 100% (1:1 match) |

The number and value of shares that were awarded to the Executive Directors during the year is set out in the Auditable section.

Implementation of policy in 2015

Base salary is reviewed on an annual basis. The 2015 base salary increases from 1 January 2015 were 3.0% for the Group Chief Executive and 3.0% for the Group Finance Director. As 2015 base salary increases for the Group are applied after the publication of this report, the comparative figure for 2015 can only be provided in next year's report. The comparative figure for 2014 is disclosed in the Remuneration Committee Chairman's letter.

The Committee does not intend to change the benefit arrangements for the Executive Directors in 2015. For 2015 the Committee has determined that the annual bonus opportunity for Executive Directors and senior executives will again be contingent on meeting targets relating to operating profit, cash management and personal objectives. The Committee has reviewed targets for the year to ensure they remain appropriately stretching and relevant for the Group's business strategy.

The Committee will review the performance measures for awards under the CIP and the BIP in 2015 to ensure they remain appropriately stretching in light of the Group's expectations in relation to performance.