Powering on

Industrial gas turbines

Power generation requires reliable moving parts that can operate for long periods under high loads and extreme temperatures. For example, the compressor comprises various stages of stationary and rotating blades, each progressively increasing air pressure prior to mixing with fuel and igniting. Around the clock, turbine blades and vanes must be resistant to oxidation, corrosion and wear, and provide longevity in service. A combination of heat treatment, Hot Isostatic Pressing (HIP) and coatings allows industrial gas turbine blades and vanes to operate reliably at these high temperatures for extended periods of time.

For further information about our services go to www.bodycote.com/services

Within the Aerospace, Defence & Energy (ADE) business, our customers think and operate globally and increasingly expect Bodycote to service them in the same way. Consequently, the ADE business is organised globally. This gives Bodycote a notable advantage as the only thermal processing company with a global footprint and knowledge of operating in all of the world's key manufacturing areas. A number of Bodycote's most important customers fall within the compass of ADE and Bodycote intends to continue to leverage its unique market position to increase revenues in these market sectors. The business incorporates the Group's activities in hot isostatic pressing and surface technology as well as the relevant heat treatment services, encompassing 63 facilities in total.

Results

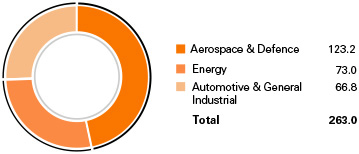

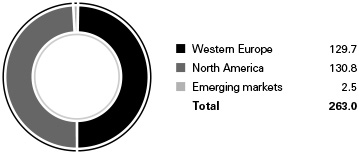

Revenues for the ADE business were £263.0m in 2014 compared to £261.8m in 2013, an increase of 0.5% (5.4% at constant exchange rates). Overall, revenues from the commercial aerospace sector remained solid but there have been significantly varying levels of demand in different OEM supply chains. Some have focused on significant destocking, while others have had robust growth on the back of new engine series and airframes. Defence demand has been subdued, resulting in further modest declines in revenue. In energy there has been a mixed picture. Requirements for industrial gas turbine have softened as the year progressed, especially in North America. Onshore oil & gas revenues grew strongly as the destocking seen in 2013, following the substantial decline in US gas prices, ended. The Group recorded strong growth in subsea revenues driven by increased uptake of the Group's HIP PF technology.

Headline operating profit1 for ADE was £70.6m (2013: £70.7m) and headline operating profit margin reduced slightly from 27.0% to 26.8%.

In 2014, the Group added capacity in a number of facilities, including a new large furnace for aerospace aluminium heat treatments in California, USA, upgraded vacuum heat treatment capability in France and additional high pressure HIP capacity in Massachusetts, USA. In the coming year it is expected that capital expenditure will be slightly above depreciation as further capacity and capability are added to support continuing growth in the Group's high value activities.

Net capital expenditure in 2014 was £18.4m (2013: £20.4m) which represents 0.9 times depreciation (2013: 1.1 times).

Average capital employed in ADE in 2014 was £236.3m (2013: £235.4m). The Group continues to invest in high-return projects in the ADE business. Return on capital employed in 2014 was 26.6% (2013: 26.1%).

Achievements in 2014

The ADE divisions made further progress during the year in gaining new agreements with a range of customers and for a variety of end uses. The HIP division made excellent progress with its HIP PF offering and revenues advanced strongly at constant exchange rates. It should be noted, however, that unusually for Bodycote, HIP PF tends to be used in large capital projects by our customers and consequently revenue patterns can be expected to be uneven.

Organisation and people

Total full-time equivalent headcount at 31 December 2014 was 1,898 (2013: 1,938), a decrease of 2.1% compared to revenue growth in ADE of 0.5%.

Looking ahead

Order books for commercial aerospace OEMs remain strong, but notable destocking at certain OEMs and their supply chains is expected to continue during 2015. If the oil price remains at current levels we expect demand from this sector to weaken as the year progresses. Defence markets are expected to remain soft. Despite this, Bodycote expects to be able to continue to capitalise on its world leading position in ADE and again outperform the market.

- Headline operating profit is reconciled to operating profit in note 2 to the financial statements. Bodycote plants do not exclusively supply services to customers of a given market sector (see note 2 to the financial statements).

ADE revenue by geography

£m

ADE revenue by market sector

£m