Staying sharp

Medical tools

Stainless steel is used widely in medical applications. It is valued as an inert material, able to withstand cleaning and sterilisation, while maintaining corrosion resistance. Demanding applications such as cutting instruments, trauma, electromechanical devices and motors require the benefits of stainless steel. These parts must resist galling, wear, and maintain a sharp edge. Bodycote's S3P processes for stainless steel provide hardened surfaces that do not crack or chip, and give superior wear resistance and strength without compromising the base material's corrosion resistance.

For further information about our services go to www.bodycote.com/services

Whilst the Automotive & General Industrial (AGI) marketplace has many multinational customers which tend to operate on a regionally-focused basis, it also has very many medium-sized and smaller businesses. Generally, there are more competitors to Bodycote in AGI and much of the business is locally oriented, meaning that proximity to the customer is very important. Bodycote's uniquely large network of 125 AGI facilities enables the business to offer the widest range of technical capability and security of supply, continuing to increase the proportion of technically differentiated services that it offers. Bodycote has a long and successful history of serving this wide-ranging customer base.

Results

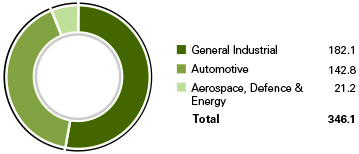

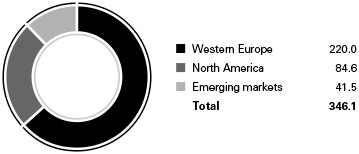

AGI business revenues were £346.1m in 2014, compared to £357.8m in 2013, a decrease of 3.3% (3.1% increase at constant exchange rates).

In 2014 sales into car & light truck have been good in all geographies, with revenues increasing by 6.0% at constant exchange rates. Revenues to heavy truck increased by 4.2% (at constant exchange rates) in North America as demand recovered well but weak economic conditions in Europe saw revenues to the sector decline by 7.6% (at constant exchange rates). General industrial markets have shown good growth in most sectors in both North America and Western Europe, with overall revenue growth of 3.4% (at constant exchange rates). Robust sales growth was seen in agricultural equipment, construction machinery and tooling, the latter typically being a leading indicator of industrial production.

In the emerging markets, AGI revenues increased by 2.8% (at constant exchange rates). Notable was strong heavy truck growth in China as a result of specific contracts won by the Group.

Headline operating profit1 in AGI was £54.1m compared to £52.7m in 2013. Headline operating margin increased to 15.6% (2013: 14.7%) reflecting improved mix and strong cost control, particularly in areas of demand weakness. Revenues from the Group's Specialist Technologies, and especially its S3P technology, grew strongly at high margins.

Net capital expenditure in 2014 was £31.1m (2013: £34.2m), which represents 0.9 times depreciation (2013: 1.0 times).

In 2015 we expect that capital expenditure will be just above depreciation as we accelerate capacity expansion in the rapid growth countries and for our Specialist Technologies. Return on capital employed in 2014 was 16.0% (2013: 15.1%). The increase reflects continuing focus on improving capital returns by increasingly targeting higher added-value activities. On average, capital employed in 2014 was £301.8m (2013: £304.2m).

Achievements in 2014

The Group continued to win business across all geographies. In both North America and Europe our ability to support automotive manufacturers as they move to newer technologies in pursuit of better fuel efficiency continues to provide Bodycote with market share growth. New outsourcing contracts and contributions from our AGI focused Specialist Technologies of S3P, Low Pressure Carburising and Corr-I-Dur® resulted in growth at constant exchange rates in all regions. Overall, revenues grew by 3.1% at constant exchange rates.

AGI continued to see the benefits of mix improvement and market focus. Together with an emphasis on improved efficiency these factors have been crucial in the achievement of ongoing margin enhancements in this business.

Organisation and people

At 31 December 2014, the number of full-time equivalent employees in AGI was 3,567 compared to 3,585 at the end of 2013 and 1,677 less than its peak in July 2008. AGI revenues of £346.1m compare to £339.6m in 2008 (at 2014 exchange rates), an increase of 1.9%.

Looking ahead

The AGI businesses will continue to build on the success of enhancing margins through capturing high value work. The focus on improving customer service helps drive this effort while the prioritisation of existing capacity in favour of higher value work and investing in Specialist Technologies provides additional momentum. In addition the Group will continue with its strategy of adding to its existing footprint in the rapid growth countries.

- Headline operating profit is reconciled to operating profit in note 2 to the financial statements. Bodycote plants do not exclusively supply services to customers of a given market sector (see note 2 to the financial statements).

AGI revenue by geography

£m

AGI revenue by market sector

£m